Note: I'm going to using NiEq% grades using a ratio of 3.2% Cu = 1% Ni.

I haven't included any of the other metals as the PGEs, Au and Ag don't always appear to be associated with the massive sulfide intervals and as I don;t know their recoveries, I don't know if an economic amount of the metals will be recovered and paid for by any smelter.

To no surprise, all of the holes are drilled in the same 300m x 200m area that we've all come to love

|

| I added the scale bar |

Results

Drilling has focused in 3 main areas- NW Zone - Holes EL-19-55 to 61

- Discovery Zone - Holes EL-19-51 to 53

- Deep Feeder zone - Hole EL-19-54

NW Zone

Seven holes were drilled into this zone to see if the massive sulfides in the NW zone link up with the sulfides mapped at surface in the NE Zone.

You'll see that the surface sulfides are found at the contact between the E&L Intrusion (purple) and the Hazelton Sediments (light green),

On the section that the holes generally hit a narrow massive sulfide zone with a small (up to 15m core length) zone of disseminated (<1% NiEq) mineralization above it. Holes 55 and 56 didn't hit any massive sulfides, and suggests that the system is dying to depth in this direction.

Discovery/NE Zones

For the discovery zone I'll write about 2 areas - Upper and Lower sulfide zones

Lower zone = main Discovery massive sulfide zone

Upper zone = small sulfide zone found ~25m above the main zone

Lower Zone

Here is a long section through the lower/main Discovery zone, I've clipped out the spurious information

We an see that hole 54 was a ~20m step-out from the massive sulfides hit in hole 53, and hit nearly 5m of massive sulfides grading 6.5% NiEq.

What is also interesting is that holes 17-12, 18-37 may not have been drilled deep enough to intersect this zone. Maybe there is a (small) chance that Garibaldi could re-enter these holes and drill them an additional 50m to check.

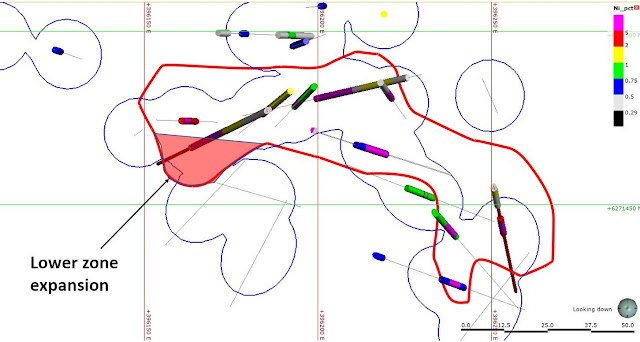

Here is a plan map of the Lower Sulfide zone. It is a busy figure

The known sulfide mineralization i about 130m x 30m and if it is 8m thick, we get:

- 130 x 30 x 8 x 4.5 = 140,000 tonnes of material

Still very small, to get a 1Mt deposit, at similar thicknesses we need a footprint of

- 1,000,000 / 4.5 = 220,000 cubic meters

- 220,000 / 8 = 27,780 m2

- or a zone that is 30m wide and 930m long (or a strike length that is 7 times longer than the current footprint.

Upper Zone

Drill-hole 51 hit a narrow zone of massive sulfide mineralization ~25m above the Discovery zone. It seems to line up with other massive sulfide occurrences in early drilling.

However, drill-hole 18-24 didn't hit anything on the up-dip continuation of this zone, so suggests that it is a small, localized sulfide body.

Deep Feeder

Hole 54 plunged the depths of Nickel Mountain.

It got a 10m zone of <1% NiEq, but nothing special. This hole was drilled to follow-up on the small zone hit in hole 17-01 (they are ~10m apart). Personally, I think that rather than being a feeder zone, what we may be seeing is the effect of s chunk of Hazelton Group sediments in the Nickel Mountain Gabbros that, due to a change in local chemistry, has led to the local precipitation of sulfides from the gabbros.

We can see on the section accompanying the press release (link) that there is a close spatial relationship between the Hazelton group and mineralization.

However, most of these points are rhetorical, to me, I can't see the evidence from the drilling that supports a big Ni sulfide system at Nickel Mountain.

I did an update to the Officially Bad Resources, make of them as you want