As we are drawing to the end of Q2 (or H1) for 2018 and we are all looking forward to Pretium's Q2 production figures from Brucejack, I've decided to do some edumacation.

Here is a nice article on evaluating high-nugget effect gold deposits like Brucejack, Pilbara etc. It is packed full of geo-porn (too explicit to reproduce here), so open the Kleenex, get something to lubricate your parts and have a gander.

Here is the link

Sunday, June 24, 2018

Monday, June 18, 2018

Defiance Anomalies

Well feck my arse, Defiance have found some geofizz anomalies at San Acacio (link). Would these be the same as the huge silver anomalies that were announced in March?

You know, the ones where you still, after >7 months, haven't managed to release any results. I ahve to say, your property must be amazing, that none,not a single one of the holes drilled as part of your 5000m program that commenced in November of last year, hit a single interval that contained a moderate amount of silver. How shite is San Acacio?

Will we ever see these results, or was this a quick PR to hide Roger's resignation that was kindly squeezed in at the bottom of the PR?

Unfortunately, I'm not an expert on the AERI geophysical method, Defiance states:

the exploration Silver Bullet, a a perfect, all singing and all dancing geophysical technique. However, I'm a bit skeptical, probably due to my lack of knowledge in the method, and I haven;t been able to fund much online, nothing about its "proof-of-concept testing resulting in multiple new discoveries in North America". So if anyone has some info, I would love to have a look.

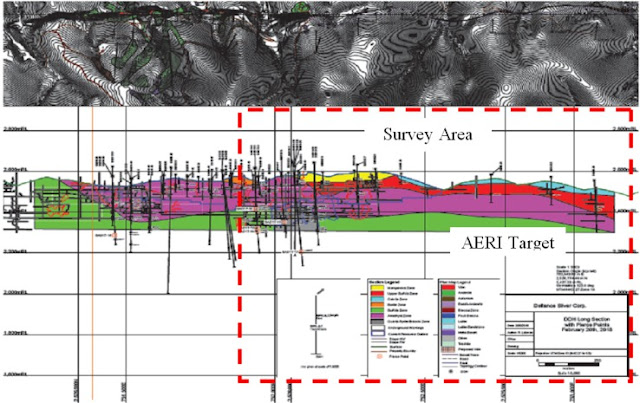

Let's have a look at this anomaly..

I love the way that you can't really relate the geofizz plan maps or sections to anything else. We can see that the Copper zone anomaly is 200-300m wide.

Defiance tell us that the anomaly compares favorable with geophysical images from the Cozamin Mine operated by Crapstone, so why don;t we compare the anomaly to a long section from Cozamin.

huge isn't it....

You know, the ones where you still, after >7 months, haven't managed to release any results. I ahve to say, your property must be amazing, that none,not a single one of the holes drilled as part of your 5000m program that commenced in November of last year, hit a single interval that contained a moderate amount of silver. How shite is San Acacio?

Will we ever see these results, or was this a quick PR to hide Roger's resignation that was kindly squeezed in at the bottom of the PR?

Unfortunately, I'm not an expert on the AERI geophysical method, Defiance states:

|

| Geophysicists, joining an dole line somewhere near you. |

the exploration Silver Bullet, a a perfect, all singing and all dancing geophysical technique. However, I'm a bit skeptical, probably due to my lack of knowledge in the method, and I haven;t been able to fund much online, nothing about its "proof-of-concept testing resulting in multiple new discoveries in North America". So if anyone has some info, I would love to have a look.

Let's have a look at this anomaly..

|

| I like the fact that only a small part of the survey area covers the resource |

|

| This survey area is different to the other, a dodgy drawing. |

I love the way that you can't really relate the geofizz plan maps or sections to anything else. We can see that the Copper zone anomaly is 200-300m wide.

Defiance tell us that the anomaly compares favorable with geophysical images from the Cozamin Mine operated by Crapstone, so why don;t we compare the anomaly to a long section from Cozamin.

|

| that massive triangle to the left. |

Tuesday, June 12, 2018

Maple Syrup....

mmmMMMMMMmmmmm

uh.....uh....uh.....again...again....mooooree....come on, don't stop...oh....oh...YES... YES...YES...uuuuhhhhh...uuuhhh...ohhhhh...aaaarrghhh

I just love spreading maple syrup on my toast, smearing it to cover all corners so that with every bite I get that sweet golden taste between my lips.

but the other thing that is great to smear are gold assays....

Maple gold recently reported some excellent results from Douay (link), but again we see that the BS-is strong with this one....

Here is a leapfrog view on the holes in this PR (link), I'm hoping to have time to compile more data from it...

Here are the back calculated grades, removing the impact of the high-grade intervals.

As we can see that most of the gold is found in a narrow high-grade zone and the majority (a small 137.2m) grades a lot less than 1 g/t Au.....

and here it is visually....

So all the gold disappears, imagine what would happen if a handsome, chiseled, well-groomed newsletter writer had expressed some concerns with these results.......

uh.....uh....uh.....again...again....mooooree....come on, don't stop...oh....oh...YES... YES...YES...uuuuhhhhh...uuuhhh...ohhhhh...aaaarrghhh

I just love spreading maple syrup on my toast, smearing it to cover all corners so that with every bite I get that sweet golden taste between my lips.

but the other thing that is great to smear are gold assays....

|

| it only took the gold from one Junior Exploco PR to kill this woman.... |

Maple gold recently reported some excellent results from Douay (link), but again we see that the BS-is strong with this one....

|

| Wow, massive gold zones.... |

| thick intercepts..... |

Here is a leapfrog view on the holes in this PR (link), I'm hoping to have time to compile more data from it...

Here are the back calculated grades, removing the impact of the high-grade intervals.

|

| aaaaand now they're gone |

As we can see that most of the gold is found in a narrow high-grade zone and the majority (a small 137.2m) grades a lot less than 1 g/t Au.....

and here it is visually....

|

| lots of nothing... |

So all the gold disappears, imagine what would happen if a handsome, chiseled, well-groomed newsletter writer had expressed some concerns with these results.......

Friday, June 8, 2018

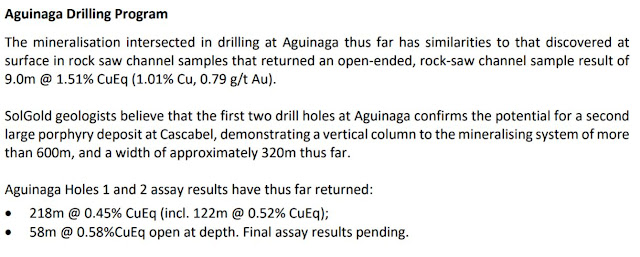

Aguinaga - initial results.

DISCLOSURE - I SILL OWN SHARES IN SOLGOLD

I apologize, in my last post on Aguinaga I made a prediction that the initial drilling would intersect:

Unfortunately, I don't think the results will be very special, I'm guessing that they come in around the 0.4-0.6% CuEq level.

and

The core photos from hole 01 look a bit anemic. They look similar to the low grade holes at Alpala, that typically ran around 0.5% CuEq (typically 0.3% Cu and 0.1-0.2 g/t Au)

This is what we got:

I'm sorry to inform you that I was correct, and I'm as concerned as you all are about this accidental correctness. I promise that it won't happen again.

I was disappointed that they didn't break down the results, or tell us how much the CuEq value came from copper and gold.

However, in the March PR (link) we were told:

So what happened to the other 100+m of strong mineralization? Is Aguinaga suffering from Cordoba syndrome - the copper mineralization was in the other half of the core that didn't get sent to the lab.

I've updated the Leapfrog View for Aguinaga (link). I've had to estimate the down-hole depth to mineralization as the "from" and "to" information wasn't included in the PR.

A quick exploration comment, the footprint of the Aguinaga porphyry looks relatively small, I'm concerned that a few of the proposed holes (including hole 3 and 4 that are currently underway) may miss it.

TL:DR version - Aguinaga isn't looking very special and the lack of disclosure on the results is really irritating. I would like to see a proper table showing a proper break-down of results.

I apologize, in my last post on Aguinaga I made a prediction that the initial drilling would intersect:

Unfortunately, I don't think the results will be very special, I'm guessing that they come in around the 0.4-0.6% CuEq level.

and

The core photos from hole 01 look a bit anemic. They look similar to the low grade holes at Alpala, that typically ran around 0.5% CuEq (typically 0.3% Cu and 0.1-0.2 g/t Au)

This is what we got:

I'm sorry to inform you that I was correct, and I'm as concerned as you all are about this accidental correctness. I promise that it won't happen again.

I was disappointed that they didn't break down the results, or tell us how much the CuEq value came from copper and gold.

However, in the March PR (link) we were told:

So what happened to the other 100+m of strong mineralization? Is Aguinaga suffering from Cordoba syndrome - the copper mineralization was in the other half of the core that didn't get sent to the lab.

I've updated the Leapfrog View for Aguinaga (link). I've had to estimate the down-hole depth to mineralization as the "from" and "to" information wasn't included in the PR.

A quick exploration comment, the footprint of the Aguinaga porphyry looks relatively small, I'm concerned that a few of the proposed holes (including hole 3 and 4 that are currently underway) may miss it.

| Will all the holes hit the target? |

TL:DR version - Aguinaga isn't looking very special and the lack of disclosure on the results is really irritating. I would like to see a proper table showing a proper break-down of results.

Wednesday, June 6, 2018

Ermitaño - a low key resource

We got a rather low-key PR from Evrim about the maiden resource at Ermitaño (link), which was surprising as there have been several PRs with some very good drill results recently (link).

This equates to approx. 3.5Mt @ 4.0 g/t Au and 68 g/t Ag or 4.93 g/t AuEq (358 g/t AgEq), which represents 95% of all new inferred resources found by First Majestic.

It looks very interesting, especially for an initial resource. However, there isn't much information on the project, all we get is a simple plan map...

and a long section..

These holes are very widely spaced (>100m), and have First Majestic inflated the tonnages by using a very big search radius (i.e. using all of the drill-hole data no matter how far apart they are)?

Here is a Leapfrog view of the data (link). I had to use trigonometry to estimate the hole lengths and dips, and so they will be a bit out.

Drill-hole spacing to define a resource varies by the deposit style and metal distribution, so here are some examples for similar (Epithermal) deposits to see what they used for inferred resources:

La Guitarra - First Majestic

Los Gatos (Sunshine Precious Metals)

San Jose (Quintana Resources)

San Martin (First Majestic)

Santa Elena (First Majestic)

We can see that there are many different criteria, but in general we get:

So First Majestic do seem to be pushing the limits for the resources limits at Ermitaño, nothing major, but a hole drilled between 06 and 10 would be a good idea to increase confidence, especially in the western area where the few, high-grade holes are >100m apart.

The fact that First majestic plan to drill 18,000m at Ermitano is very positive, it shows that they are confident in finding new zones and expanding on the known resources, but it would be nice to have a bit more information (e.g. where the heck is the Aitana vein located) showing targets and proposed exploration areas.

| Realistic metal prices....not! |

| Lol |

and a long section..

|

| Low grade zones always are on a diet, whereas high-grade area (like small dogs) expand to fill as much space as possible... |

Here is a Leapfrog view of the data (link). I had to use trigonometry to estimate the hole lengths and dips, and so they will be a bit out.

| My long section (looking north - east to the right). Showing DH intercepts and 50m, 100m and 200m radius buffers. |

La Guitarra - First Majestic

Los Gatos (Sunshine Precious Metals)

San Jose (Quintana Resources)

San Martin (First Majestic)

Santa Elena (First Majestic)

We can see that there are many different criteria, but in general we get:

- Indicated Resources ~50m sample/drill-hole spacing

- Inferred Resources >50m (but anything massively over 100m is unrealistic).

So First Majestic do seem to be pushing the limits for the resources limits at Ermitaño, nothing major, but a hole drilled between 06 and 10 would be a good idea to increase confidence, especially in the western area where the few, high-grade holes are >100m apart.

The fact that First majestic plan to drill 18,000m at Ermitano is very positive, it shows that they are confident in finding new zones and expanding on the known resources, but it would be nice to have a bit more information (e.g. where the heck is the Aitana vein located) showing targets and proposed exploration areas.

Saturday, June 2, 2018

Platosa - Mexico's highest cost silver mine

huuuuuuuuuuuuuuuuuuuuuuuuuugnn Platosa mmm mmmm MMMMMmmmm

| Halve production and double costs |

| even the exchange rate works in their favour |

An IRR of just 118% with some very conservative metal prices. This mine must make money hand over fist. So why have Brendan and his team raised ~C$41.6M since Q3, 2015?

- C$6.6M in Nov 2015

- C$2M in Osisko (Oban) shares for the DeSantis Property

- C$3M in march 2016 from Sprott

- C$15.2M in July 2016

- C$14.8M in Sept 2017

According to the PEA, this mine should produce an embarrassing amount of money?

Let us check that visually, this is just a quick graph showing cumulative net profits or loss compared to cumulative funds raised.

Ohh, so they've actually made a cumulative loss of ~C$24M since mid-2015, with just 1 quarter (Q4, 2017) out of the past 11 where they have made a profit, and even after the "turnaround"

It is nice to see another successful mining company with a mine matching its PEA.

What is cool is, their current working capital is ~C$14.5M, which means that they have already started to chip away at the C$14.8M they raised last year, so hopefully with the Hecla lease they'll actually make some money before they have to raise some more.....

Subscribe to:

Posts (Atom)