All projects are great from afar.....

Summary

- A large, but low grade resource and with a very small 'high-grade' zone.

- Good recoveries, but minimal by-product contribution

- >95% for Copper

- 55-70% for Mo

- Expansion of near surface resources looks limited, but hole V2017-10 did intersect some interesting grades at depth.

- Bad geography, located in the bottom of a relatively steep valley, this could have big implications on strip ratios as minor changes in pit slope angle may mean moving very large amounts of waste rock.

- 2014 PEA show that a small (40 ktpd) operation is very marginal and that very minor (5%) increases in CAPEX or OPEX will have a major impact on the project economics.

- So, Vizcachitas is too small, too low grade with marginal economics. As they say, can't make a silk purse out of a sow's ear.

Geo-babble

DISCLOSURE: I've compiled as much of the information as possible that is in the public domain. However, I've had to estimate the angle of dip, and I'm sure that I've only been able to find summarized assay data for ~65% of the 'deposit'.

You can download the Leapfrog project from here (link)

Resources

The first area I wanted to look at is the quality of the resources, especially the tonnage at high, medium and low cut-off grades.

|

| lots of high-grade, just not in the resources.... |

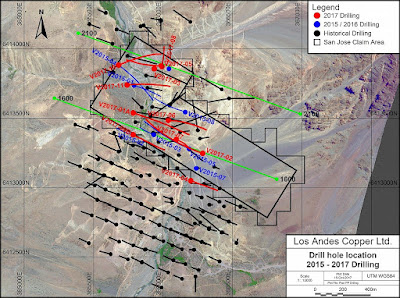

However, the recent drill results have been interesting (link) with some (reported) thick, reasonable grade intercepts, but we need to check where these holes have been drilled (link).

You can quickly see that the majority of the new holes are clustered in areas of known mineralization, with a couple, including hole V2017-10 drilled to the north.

In the image below I have created a >0.4% Cu grade shell for the project using (left) pre-2015 drilling and (right) all drilling. To see how the resource has changed.

|

| changes circled in red |

Here are some sections, you'll notice that the >0.4% Cu zone doesn't extend to great depths.

Section 2800N

Section 3400N

Section 3900N

These zones aren't very thick, but we can see that the mineralization in Hole V2017-10 is open in several directions, but is deep, all other mineralized zones appear to have been close off or are very narrow, so unfortunately, I can't see much exploration upside.

Development

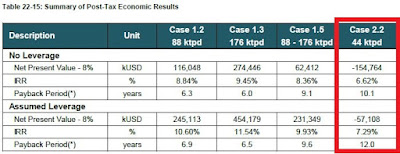

There are rumors that Los Andes want to re-market Vizcachitas as a small (40,000 tonnes per day), high grade deposit, and we are fortunate that a financial analysis of a 44,000 tpd operation was include in the 2014 PEA.

I mean, I like the fact that they are so modest, a discounted NPV of just US$3 million is quite cute when compared to other large copper projects, and a leisurely payback period of a decade, I mean why make money quickly, when you can make it slowly and savor it.

I mean look at the numbers, all the best projects, like Livengood's epic 2013 PEA, you have a positive IRR and a negative (discounted) NPV.

It is going to be a lot of fun developing such a marginal project, where any minor increase in CAPEX or OPEX with rape you up the ass. Personally, I can't think of any mining project that has every gone over budget or not completed on time.

One the cross sections above I put on the surface trace. It shows that the mineralization is found at the bottom of a steep valley, that Los Andes loves to take photos of:

|

| a river runs through it.. |

So, it is a bit hilly, has a river than runs through the project (that hopefully isn't a water source for any urban centers), so another factor that will impact the economics of the project is the pit slope angle. Back in 1999, Golder estimated a 42-47 degree angle, and I've doodled it on the best section, along with steeper and gentler angles

You can see how much additional rock (grading less than 0.4% Cu) needs to be moved.

The same will happen if you decide to mine the deeper resources, as you go deeper you needs to move more and more low-grade waste rock on either side of the deposit.

So, after all of this blathering, you can see that the project simply isn't good enough, the economics are crap, and just a minor change in CAPEX, OPEX, metal prices, rock quality and stability can conspire to wreck it. The recent exploration data hasn't shown any upside, just a single hole that hit some medium grade mineralization at depth.

Interesting stuff TAG. Without checking notes, the 0.4% shell in sections 2800 y 3400 looks a little horizontal ?weak enrichment? - perhaps the best it is going to get outside of high grade structures. Not certain if it was in this valley but somewhere down stream there is a water dam if not hydroelectric facility.

ReplyDeleteRegarding the weak supergene enrichment, yes it does occur, in the earlier technical reports it was modeled as a separate zone, but as it contained significant sulfides, in the later resource calculations and PEA study, the oxide/enriched zones were merged into the rest of the hypogene mineralization.

ReplyDeleteI'll have to check, I know that downstream is where the proposed mill-site has been identified, but this is really semantics as the deposit isn't good enough to go into development.