Summary.

- Kilgore currently contains a small, low grade resource (2012 - link)

- 47.5Mt @ 0.53 g/t Au or ~820Koz contained gold

- There appears to be some potential issues with drill-hole assay data

- Resource calculations appear to be overly optimistic

- Recent drilling have returned some decent grades (link and link), but they look to be minor step out drilling from earlier holes, and

- Best hits appear to have come from narrow, vertical high grade zones - so probably won't be very large

Background

Kilgore was essentially dormant from 2012 to 2015, when Otis managed to raise some funds and have been drilling the deposit on and off since then. Here is the location of the recent drilling:

We can see that:

We can see that:

- The majority are infill holes - i.e. drilled within the limits of known mineralization. This is done to:

- This provides more information to better understand the mineralization - change the QUALITY but not QUANTITY of resources (i.e. move inferred resources into the M&I category)

- New interpretations may have identified new targets. Infill holes maybe drilled to a greater depth to test these ideas (2 targets tested with 1 hole approach)

- The historic drill data is missing/incomplete/low quality and new holes are drilled to confirm the historic data, so that the old holes can be used in resource calculations.

- Low risk drilling - get some decent grades for the press releases.

- A small proportion are minor step-out (up to 100m) drilling looking to expand the mineralization where it hasn't been fully closed-off.

So, not very adventurous, but when you look through the technical report you see this:

|

| so potentially a third of the assay data at Kilgore is suspect |

Visually

|

| you want the sample points to plot close to the green line |

This simply says that the RC drill samples, on average returned twice the gold grade than diamond drill samples from the same area.

Here is what they say in the technical report

RC and core assays do not compare well, with paired data comparisons and separate estimates showing that RC assays are higher than core. Issues are identified with both types of data which will not be fully resolved without collecting bulk samples. The various operators of the project have been alert to recovery and sampling issues and appear to have taken measures to reduce sample bias, reflected in the core drilling techniques used.

and this

So I'm guessing that the bulk of the drilling was done to resolve these issues and 'remove' the RC drill-data for future resource calculations. This was a sensible thing to do, but I was surprised that they were able to calculate a Indicated resources with these issues.

Why don't we look a bit more at the 2012 resources

Have any tricks been used to make the resource appear bigger and better? Yes....

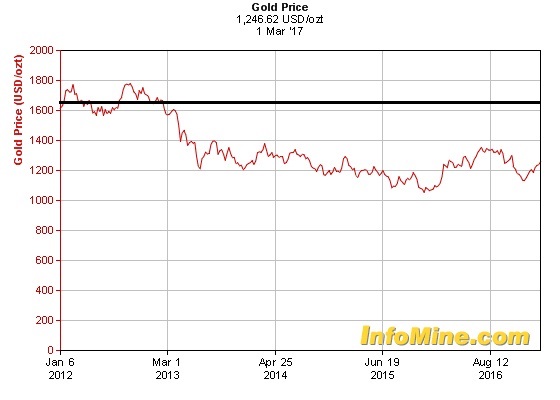

Trick 1 - The use of an unrealistically high gold price - In this case $1650/oz.

If you use a high gold price, you are saying:

- Your rock is worth more (i.e. more bucks per tonne), and assuming 100% recovery, a tonne of Kilgore 'ore' is worth

- @ $1650/oz = $28.12/tonne

- @ $1500/oz = $25.56/tonne

- @ $1250/oz = $21.30/tonne

- You need less gold to cover the mining and processing costs, which means you can use

- A lower the break-even/cut-off grade

- where $value of gold in rock = extraction costs

|

| thick black line = $1650 |

Since 2012, there have been 7 months where gold prices are >$1650, and even when the report was being written the gold price was ~$1600/oz. A more realistic conservative price would have been $1500.

Trick 2 - The use of an unrealistically high recovery - 90%

If you use a very high recovery, again, you increase the value of gold in the rock:

- Kilgore - average grade = 0.53 g/t Au

- Recovery = 90% (recovery used in the cut-off calculation in the 2012 technical report)

- 1 tonne of 'ore' contains

- 0.53/31.1 = 0.017 oz/t Au

- 0.017 * 0.9 = 0.015 oz/t recoverable gold (the rest is lost)

- 0.015 * 1650 = $25.3/tonne

- @ 80% recovery = $22.50/tonne (11% less)

- @ 70% recovery = $19.68/tonne (22% less) and so on

So where did Otis get this 90% recovery value? They must have got it from the various metallurgical studies they have conducted at Kilgore:

- 2010 study - average recovery = 78.7% recovery

- 2011 study

- Average Recovery = 79.45%

- Average grade of metallurgical samples = 1.12 g/t Au (or 211% of the average grade)

- 2012 study - average recovery = 56%

Note: these are arithmetic means, we can see that recovery varies by rock type, grade and how coarse the samples were, which is normal for all deposits.

|

| You can see that recovery >70% after 30 days of leaching, and never gets above 80% |

|

| Same rock, but now oxidized = we can see that a finer grind = higher recovery, but still no 90%! |

So, the highest recovery they got from actual studies was ~80%, but in the 2012 resource calculations they've used a very high gold price and an unrealistic recovery value - this means that the cut-off they used is artificially low.

Why is this a problem?

Well, in most deposits, grade follows a simple distribution:

- A small amount of high-grade

- lots of low grade

|

| As cut-off grade increases, tonnage decreases |

Blue line = amount of material at each cut-off grade

Dark red line = average grade of the resources at each cut-off grade

Green line = total ounces in resources at each cut-off grade.

- 0.00 oz/t cut-off = 74.1 mt @ 0.009 oz/t Au or ~660koz

- 0.007 oz/t cut-off = ~30mt @ 0.018 oz/t Au - or 520Koz Au - 60% drop in tonnes and a 22% drop in contained ounces

- 0.015 oz/t cut-off = 12.2mt @ 0.028 oz/t or 337Koz Au - 84% drop in tonnes and a 49% drop in contained ounces

- 0.03 oz/t cut-off = 3.5Mt @ 0.045 oz/t or 158Koz Au - 95% drop in tonnes and a 75% drop in contained ounces.

So you can see there is lots of low grade, but significantly less high grade, and you can see why companies want to use as low a cut-off value as possible - as it means that they can include lots of the low grade material into the resources, but this has 2 effects:

- Increases the tonnage and contained ounces, but

- decreases the average grade of the deposit

So you end up with a big, crap deposit.

However, you can do a bit of maths and using current metal prices ($1250/ounce), and real recoveries (80%), we can try and calculate a new cut-off grade, so see what could happen to the resources.

I've assumed that mining and processing costs will be ~$10.5/tonne (from the technical report), and from this we get an updated cut-off of 0.01 oz/t, which from the grade-tonnage chart means we have (M&I):

- 20.6mt @ 0.021 oz/t for 441Koz contained gold, or in real units

- 18.7Mt @ 0.72 g/t Au

So we have gone from 520Koz Au down to 441Koz, so goodbye 80Koz Au, it was nice knowing you....

So, It will be interesting so see what values Otis use in the updated 43-101 slated to be released this year?

Geology Wank

We'll ignore this for now and have a look at the assay data. I've only been able to work with the recent drilling data, and you can download my model from here (link)

Here is a generalized section through the deposit, look how the gold resource is centered on a fault, and extends into the lime green Tlt (Lithic tuff), so we should see 2 control on mineralization:

- A vertical, structural/fault control on the high grade (>1 g/t) mineralization

- A horizontal, control on the low grade (<1 g/t) mineralization - this is probably due to lithology (contacts between rocks), a sill etc.

I was quite surprised to see this in the 2012 technical report:

It appears that to calculate the resources, they have used a simple, global trend (black line), and when you look more closely, you can see that the high grade zones (red) that don't quite fit together, and occur as random splodges. This suggest that the high-grade mineralization is probably controlled by vertical structures and using the general trend, may have overestimated their size in the 2012 resource.

This is what they say in the technical report

Kilgore drill orientations are locally limited due to permit restrictions and topography. The drill hole

orientation is not optimum for the capture of structurally controlled mineralization. Some drill holes are oriented along mineralized structures, whereas others miss it altogether because they are drilled

parallel to them.

orientation is not optimum for the capture of structurally controlled mineralization. Some drill holes are oriented along mineralized structures, whereas others miss it altogether because they are drilled

parallel to them.

This means you can have a really nice, long, high-grade intercept that came from a hole drilled down the middle of a structure, and in an adjacent hole, get nothing. If that is the case, you have to be really careful about modelling the grade, you CANNOT use a generic trend. but let us look at the data in 3D, I only have the recent drilling data (i.e. drilling since 2012), but it is useful:

A long section

|

| Left - to the SE, right - to the NW |

Here are some cross sections, and look how the grades change between drill-holes.

You can see that the highest grades are very restrictive, and I feel they relate to vertical faults and structures, and the gold is bleeding out along the rock contacts to form a low grade zone around these high grade structures. and this is what happens to the grade shells with different generic trends.

No trend - Leapfrog looks in all directions equally

Horizontal (Lithology) trend - Leapfrog biases the search along the black line

|

We can see that the high-grade some is a bit bigger than before. |

Vertical trend - bias along vertical structures

|

| High-grade zone a lot smaller |

So you can see, very quickly how changing the trend on how the grade shells are created can have a drastic impact on the amount of resources calculated, and you have to be very careful and make sure you understand the controls on mineralization. In many cases you can't use a generic trend.

So we have a small, low grade deposit, with issues, and overly optimistic historic resource.

Upside Potential

Otis and previous companies have conducted a lot of exploration at Kilgore that have identified several other targets.There has been a lot of drilling outside of the Kilgore deposit.

And form the map above, they have identified erratic gold mineralization, up to 52m @ 1.25 g/t Au. I don't know if these holes have been followed up, and as they are RC holes, the grades are probably suspect, but it does show that there is gold and there are some good starting points for drilling in 2017.

Do I think that they can define >2Moz at Kilgore? I think that is an upper limit, and the 2017 updated resource calculation will tell me how wrong I am.

Thanks TAG for this detailed analysis.

ReplyDeleteAny chance you take some time to study the impressive drilling results of Tethyan Resources in Serbia?

- 356 m @ 0.38% copper and 0.31 g/t gold from 48 m

- 285 m @ 0.31% copper and 0.33 g/t gold from 42 m

- 567 m @ 0.28% copper and 0.45 g/t gold from surface.

http://tethyan-resources.com/

I'll have a look

DeleteWhat is the best way to directly contact you?

Deletehello Clayton, easiest way to contact me is by e-mail

Deletetheangrygeologist@gmail.com

First, excellent analysis of a dog I've sent to the pound because of recently unimpressive drilling results.

ReplyDeleteSecond, Moneta Porcupine is a strange agent, with zero in the way of press releases for months despite about 40,000 in announced drilling commencing in 2016. Have you looked at this one in the past, or would you consider in the future?

I'll have a look

DeleteSimilarities here to Grouse Creek, a deposit Hecla tried to mine in the 1990s and found the grades lower than expected (similar drilling issues w/ washout in tuff/breccia?) and the subvertical zones too difficult to exploit via open pit (dilution from poor separation between ore and waste). http://www.spokesman.com/stories/1996/apr/18/grouse-creek-mine-gets-reprieve-hecla-sticks-with/

ReplyDeleteshhh, I'm sure it is illegal to talk about Grouse Creek in Idaho

DeleteDon't worry, I was given special immunity from prosecution by Rick Tschauder.

DeleteReally, as in seriously, excellent analysis. Thanks

ReplyDelete