|

| left = trenches colored by number; right = trench Au assays |

I've drawn on a guesstimate >1 g/t Au contour. We can see that this zone has approximate dimensions of 250m x 125m.

Why don't we focus on the very high-grade part of trench 4

|

| Welcome to the nugget effect! |

We can see that the ultra-high grade assays in trench 4 aren't repeated in the corresponding/adjacent samples in Trench 1. We can also see that they are less than 5m apart and that ultra-high grade zone is very small (6m x 6m).

We can also see that there are only 4-5 samples containing >30 g/t Au, and in the last post we saw the dramatic effect they had on the overall average grade for Trench 4. If this was drilling data, we would expect a top cut to been applied (here is a great presentation on cutting/capping high-grade samples - link)

Here is a semi-log graph of the assays - basically we're looking at how many samples (y-axis is frequency) occur within a certain assay range.

For example: In the chart below, the highest bar tells us that 38 samples returned assays between 1.5 and 2 g/t Au.

|

| We seem to have 2 populations of samples, one centered ~1.5 g/t Au (red dashed curve) and a second at 0.1 g/t Au (blue dashed line). |

- Trench 4 now returns 106.2m @ 3.74 g/t Au - still good, but a >70% hair-cut

What else can we see? Look at the orientation of the trenches. They have 2 main directions:

- Trench 1 - NE-SW orientation

- Trenches 2, 3, and 4 - NW-SE orientation

Why did Evrim choose those orientations? Are there any clues?

Have a look at the streams.

|

| red and blue dashed lines = possible structural trends |

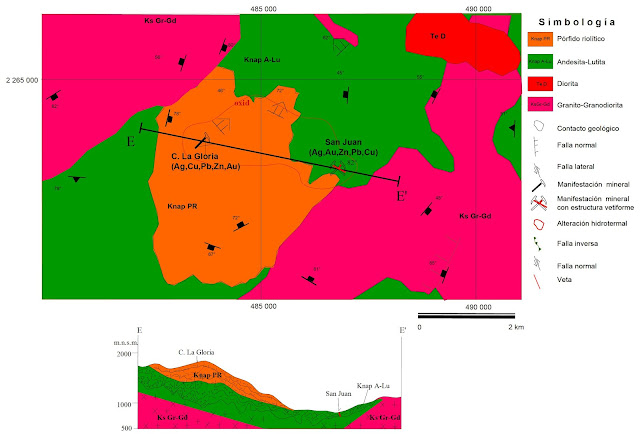

Have a look at the San Juan Prospect (which I think is within the Evrim mineral concessions). The SGM have mapped an almost vertical NW-SE (125 strike) trending vein, and in the accompanying geological report (link - in Spanish), we also have a photo

|

| vein - brown thingy next to the dude, probably a geologist as he is incredibly brave and handsome |

Now we can see that trenches 2, 3 and 4 are highly likely to have been excavated along some structures.

If you want to have some more fun, you can do some indicator kriging back of the envelope calculations to have a high quality resource calculation guess at contained gold.

- Dimensions > 1 g/t Zone = 200m x 120m x 100m (depth extent)

- Specific gravity - 2.8 tonnes/m3

- Average grade = 1.5 g/t Au

Tonnage = 200 x 120 x 100 x 3 ~ 7.2Mt

Contained gold = 7,200,000 x (1.5/31.1) ~ 350Koz Au

These numbers are complete BS, but can be an interesting guide to potential size. Fingers crossed that they get massive thick intercepts of >1 g/t Au!

I think there's a simple explanation for the trench orientation. The prospect sits on a ridge line oriented NE-SW. Trench 1 is along a topographic contour, as it's the easiest thing to do.

ReplyDeleteTotally agree with your size assessment. Then I wondered why the stock popped that much. Sure, nice results but very early days. Hopefully the project ends up like La India but its very hard to tell where a few Mozs are going to come from.

How dare you use logic on this blog!!

DeleteI was more referring to the orientations of trenches 2-4, I should have been more clear with my comments.

The only way to build up size potential is to drill, but from the poor quality sat image, I couldn't see a huge alteration halo, but there is a lot of vegetation. obscuring everything. The reason for the share pop is that it is on Exploration Insights radar, so any good news will have a lot of readers and share buyers.

not on this, it could be an opportunity for a short as the market will be expecting more 100m @ >10 g/t trenches, but when realization sits in, the share price will move back down to ~50c range.

ReplyDeleteIt sure could be a short but then again it sure is interesting that Joe hasnt sold a share and he's more than capable of doing his own similar analysis...but then again, words are cheap aren't they.

ReplyDeleteJoe is much more intelligent than I, he also bought shares at a great price and made out like a bandit. I hope the surface samples are the tip of the iceberg and it turn out into something massive.

DeleteEvrim did apply a 30 g/t top cut. Read the press release!

ReplyDeleteHello Anon,

DeleteThere was a top cut applied to the table, but not the PR headline. I wish companies would be consistent as it means that the headline doesn't match the table.

I think the subdued enthusiasm you present is a good thing for the stock. However, your analysis is grasping at straws and IMO ignoring the limited geologic interpretation VM has provided. EVM claims a much larger alt zone and that post-mineral volcanics cover the western extent of alt. They think they are in a dome field and have sampled (anomalous) silica ribs down hill to east. At this early stage we are all guessing like the five blind guys and the elephant parable. Time and drilling will tell but even excluding the HG samples, the oxidized trench results are a pretty good start.

ReplyDeleteI agree, I haven't been to the field in that area so can't confirm geology, alteration footprint host rocks. Even EVM don't have any surface geology maps on the website, just a simplified alteration map, so from far in internet-land I can't tell what the geology is, and the SGM maps are notoriously poor in quality, but can be useful guides.

DeleteI hope it is the first of many HS-zones they define and the host rock is permissive to host bulk tonnage disseminated targets. We'll see what happens and how EVM advance it. The potential negative is that with such interest, they get pushed into drilling before having enough targets defined. However, they are fortunate that they have a decent cash reserve so that they can advance the project at a decent pace and not be bullied by the market into rushing into things.

Brent, I look forward to reading your site visit report on EI. Need anyone to carry your backpack?

DeleteThe exploration history of La India is interesting. Took a good few years for Grayd to explore the property and get 2-3 M Ozs. That stock was under-valued for a long time.

Cuale could easily be similar to La India. Who knows.

The irony is, is 2-3Moz large enough to get a major involved to develop the project?

Delete"The potential negative is that with such interest, they get pushed into drilling before having enough targets defined. "

DeletePaddy isnt bullied into much and he has more patience than Job when required. I've followed Paddy for a long while and consider these faux "risks" as nothing more than words in an HTML content management solution. You clearly dont know management nor the deposit well at all. Its nice/easy to arm chair it, innit?

As for is 2-3M ounces large enough for a major, ask Joe M. He'll address that question front and center.

and very comfortable...

DeleteI have met the management, but just at various conferences, and all the info I have on the project is what has been published, and the reason i include a link to the Leapfrog viewer file is that you can download it and have a look.

i propsed the 2-3Moz question as major companies often state - E.g. Randgold hey want a minimum of 3Moz mineable gold (http://www.randgoldresources.com/what-we-do), so at the moment, the footprint of the Cuale zone appears to be small (but we are very early days).

Massive Apology - I forgot to include the link to the Leapfrog file, which is here:

ReplyDeletehttps://drive.google.com/open?id=1dxkRzsO1tHoWBNdD5k8yd9jNGKDEINXR

sorry about that, if you want the complete version (with the topo and SGM geology, flick me an e-mail

Very well presented project merit decipherment write-up

ReplyDelete