Sorry, I've been a bit snowed under with work, here is a quick update with the new drill holes released by Sol Gold a couple of weeks ago (link) and last week (link).

I've also done a complete rebuild of the model to make sure that it matches SolGold's maps as accurately as possible.

Summary

- Lots of grade smearing in latest PR

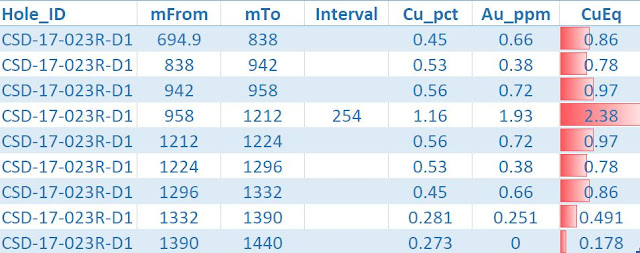

- Hole 023R-D1 - 254m @ 1.16% Cu and 1.93 g/t Au, surrounded by material grading less than 1% CuEq

- Hole 024-D1R - 512.9m @ 0.53% CuEq, in reality is 160.8m @ 1.19% CuEq surrounded by materail grading less than 0.5% CuEq

- High-grade (>1% CuEq) mineralization restricted to very narrow zones - SolGold even tell us that these zones are 2-4 times narrower than the reported intervals

- Bulk of the rock at Alpala grades <1%CuEq, which is probably uneconomic to mine

- I haven't updated my calculations as I don't have sufficient data quality (due to grade smearing) to produce an accurate number.

Background

Just a quick summary on how the model was created and how the data was extracted, I know this is probably repeating a lot of what you already know, but it is important as it shows how results can be skewed.All data is from the public domain (i.e. SolGold Press releases and presentations).

This means that I have to estimate hole locations (I georeference the plan maps), direction and dips. They are moderately accurate, but not perfect. there is a lot of guess work to make the hole line up as closely as possible.

The assay data comes from the Press releases, and I run it through Corebox's excellent Drill Hole Interval Calculator tool (link) to back calculate the residual grade of the rocks that surround the high-grade intervals. This is done to see how much of the grade is in that narrow high-grade zone, and if the surrounding rocks actually contain enough metals to be mined.

You can download the latest 3D viewer file from here (link), but you'll need to download the latest Leapfrog Viewer program to be able to open it.

When you look at the press releases for the Apala drilling you need to be thinking the following:

- How are the results being presented in the best way possible

- How will the deposit be mined

To be logical, let us start with point 2 - how are they going to get the crap out of the ground?

Here is a section through Alpala.

Decent mineralization starts at ~700m below surface, so if it gets mined, they will be doing it from underground. If used several images from a report written by Macquarie Research on Block caving (link).

Large scale underground mines have several 'unique characteristics'

- They require a higher CAPEX than a similar sized open pit operation

- Have higher operating costs

- They take longer to develop and ramp up to full production

- 5 years of underground development

- 5-7 years to ramp up periods

As a result, they are much more sensitive to changes in metal prices and Capex. However, they can have better returns on invested capital compared to open pits.

However, Alpala is an exploration stage project, we don;t need to get bogged down by all that engineering crap. However, their repot had this figure.

Think of this as a reference diagram, plot on where Alpala should sit along the red lines.

Which line do you choose? Well, look at the assay tables in any of the press releases and you see how SolGold have calculated their CuEq grades

So, draw a line on it for US$1300/oz for Gold and $3/lb for copper, and then a horizontal line back to the Y-axis (CuEq%) to see what grade Macquarie think you need for a viable underground block-cave greenfield project like Alpala.

Here is my version:

So ~1.5% CuEq for Alpala to be a standalone, viable project.

Point 1: The results

Why don't we now look at the assay table from the latest PR, reporting the mineralized intervals from holes 023R-D1 and 024-D1R.

At first glance, everything looks awesome. Hundreds of meters of decent grade material. I mean EVERYTHING in hole 23R-D1 is ore, hole 024-D1R is less good....

However, there are some clues that not all is as rosy as being presented.

To me, this mean that that they a narrow very high-grade zone surrounded by low grade crap.

This means that SolGold's geologist believe that the true with of the intercepts are 2-4 times narrower than the interval length reported in the table, so:

Very hard to see on the plan map in the press release, but fortunately with the power of Photoshop, we can lighten this image. I've chucked on my interpretations for fun.

The most consistent mineralization is around holes

Here is a zoomed in part of holes 15, 16 and 23 which is where holes 29, 29D1 are all heading, but that zone only has a 200m x 150m horizontal extents. The rest of the high-grade is quite scattered and look to be dikes.

We can see the individual assays, they are a bit blurry as I've zoomed in really close, but you can see the individual assays and you can see how quickly the grade drops off around the high-grade samples.

Look at the plan map, how when you look closely, most of the >1% CuEq mineralization is restricted to narrow zones, that are hard to join together. there doesn't appear to be a solid, high-grade core, just a lot of narrow high-grade dykes surrounded by mineralization that would be marginal if exposed at surface, but at >500m depths, it will never be touched.

I'm a bit disappointed, and gut feel is that the actual resource will be significantly lower than what the market expects, as these high-grade zones aren't consistent and don;t appear to join up.

However, I invested in SolGold for the other targets, I knew that Alpala was deep and probably not good enough as a standalone deposit. I want to see them drill somewhere else.

If you want the full Leapfrog project - e-mail me at theangrygeologist@gmail.com and I'll upload it for you

Why don't we back-calculate the residual grade

Hole 023R-D1

They have decent stuff from 958m to 1212m, but the rest is crap.

Hole 024-D1R

Same story here, but then again, they drilled the same zone hit by hole 024

For these 2 holes, only a very small portion (36% for hole 023R-D1, and none of hole 024-D1R are good enough for an underground mine. Most of what they drilled in these 2 holes is mineralized waste.

They even tell us that the mineralization is narrow in the text below the table. it says:

This means that SolGold's geologist believe that the true with of the intercepts are 2-4 times narrower than the interval length reported in the table, so:

- 745.1m @ 1.29% CuEq mean that the true width of mineralization is between 186.3 to 372.55m wide.

Very hard to see on the plan map in the press release, but fortunately with the power of Photoshop, we can lighten this image. I've chucked on my interpretations for fun.

The most consistent mineralization is around holes

Here is a zoomed in part of holes 15, 16 and 23 which is where holes 29, 29D1 are all heading, but that zone only has a 200m x 150m horizontal extents. The rest of the high-grade is quite scattered and look to be dikes.

|

| horizontal distance between the 2 lines = 35m |

We can see the individual assays, they are a bit blurry as I've zoomed in really close, but you can see the individual assays and you can see how quickly the grade drops off around the high-grade samples.

Look at the plan map, how when you look closely, most of the >1% CuEq mineralization is restricted to narrow zones, that are hard to join together. there doesn't appear to be a solid, high-grade core, just a lot of narrow high-grade dykes surrounded by mineralization that would be marginal if exposed at surface, but at >500m depths, it will never be touched.

I'm a bit disappointed, and gut feel is that the actual resource will be significantly lower than what the market expects, as these high-grade zones aren't consistent and don;t appear to join up.

However, I invested in SolGold for the other targets, I knew that Alpala was deep and probably not good enough as a standalone deposit. I want to see them drill somewhere else.

If you want the full Leapfrog project - e-mail me at theangrygeologist@gmail.com and I'll upload it for you