now some piccies

Hole 48

This is an infill hole, it is 16m from holes EL-17-09 and 10 and 10m from holes EL-17-14

However, the when we look at the lauded 44.5m at 1.2% Ni and 0.8% Cu we quickly see in reality this wide zone is really running ~0.5% Ni and Cu with the majority of the metals in the ~5m wide massive sulfide zone.

Hole 53

What we predicted, again, the massive sulfide zone was slightly wider than I had doodled in an earlier post.

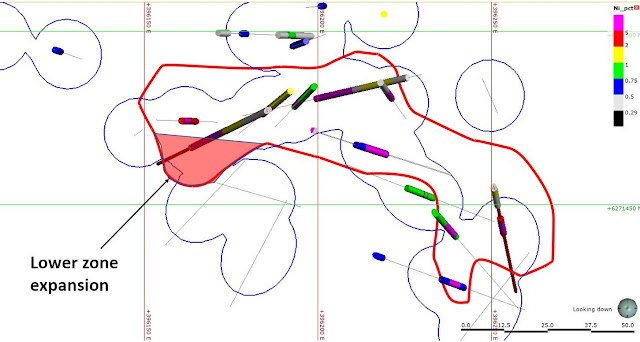

How do this change the lower zone massive sulfide footprint?

|

| a bunion |

So how big is Nickel mountain? Here is my modeled Ni mineralization

Which gives me an approximate size of...

As people got butt-hurt about me comparing Nickel Mountain with Voisey's Bay, here it is compared to a multitude of Nickel deposits (source - link).

So, it isn't, what you would call a tier-1 deposit

put in some more drillholes there and the whole deposit will already be mined via drilling and could be visited in the core shack

ReplyDeleteProbably worthwhile pointing out that hole 54 is actually less than 20 meters away from hole 1 at depth where the "second magma chamber" was *just* discovered. https://twitter.com/tombszabo/status/1172291278656032768

ReplyDeleteUh that’s text book drilling. You go deeper. This isn’t a gold porphyry. Keep yapping though. Both your reputations will be even worse soon. The funny thing is that you both KNOW this will be massive much like Pretium is but you carry on and on with your garbage. Keep up the good work. You haven’t been right yet.

DeleteAs per the companies Feb 21st NR "A further review of data related to Garibaldi’s first drill hole at Nickel Mountain in August 2017 suggests that EL-17-01 was even more significant than initially believed. EL-17-01 provides geochemical and geological evidence that there is a separate and deeper chamber approximately 160 meters below the Lower Discovery zone." They were aware that something was potentially there, and hole 54 seems to be a follow up on that area.

DeleteFurthermore, Nickel/Copper PGE magmatic sulphide deposits typically have 1 area with a higher nickel ratio (lower copper) and another section with higher copper/PGE/Gold compared to nickel, and the bottom of hole 1 fit the bill. Anyone paying attention would have been at least curious as to why the ratio of mineralization was off from closer to the surface, and those who have knowledge would have seen it as a sign of a deposit "Higher grades of copper (0.80%), palladium (1.26 g/t), platinum (0.60 g/t) and gold (0.60 g/t) were intersected over 4.5 meters starting at 279.5 meters within a broad disseminated zone."

DeleteHole 54 was drilled less than 20 meters from Hole 1. Most people would call that "twinning a hole".

DeleteHole 1 didn't hit massive sulphide mineralization, Hole 54 did. So it's a good point you bring up, we're seeing a higher grade segment, within a disseminated halo. Which is typical within these types of deposits. The disseminated mineralization acts as a guide to massive sulphide mineralization (Eagle is a GREAT example of how following disseminated ore leads to massive sulphides) - as per the news release "EL-19-54 cut six separate intervals of mineralization totaling 142 meters including a total of 8.9 meters of massive sulphides and 133 meters of mineralized gabbro and sediments" And you drill short intervals from known mineralization when you're doing exploration drilling for nickel/copper sulphides. 20m is textbook, because it means there's continuity and continuity builds tonnage. Hole 54 did more than than poke at a new chamber "Drill hole EL-19-54 (assays pending) has extended the Lower and Upper Discovery Zones to the west by 14 meters and 33.5 meters, respectively." So the overall impact of hole 54 is adding to the existing orebodies 160m above this newly discovered chamber.

DeleteI want to correct my above point, the massive sulphides from 54 were found MUCH higher than this new chamber. Hole 1 encountered disseminated sulphides, Hole 54 encountered "strongly mineralized olivine gabbro" - which will likely be disseminated as well. Garibaldi seems to be poking around a new disseminated halo, and hopefully there are massives there as well (as seen above in the deposit)

DeleteThanks for your self correction. Note how they described Hole 1 prior to assays, pretty similar I would say. I wouldn't expect any major grades in the "second magma chamber". The only thing Hole 54 really does is indicate, as they state in the NR, that a gabbro unit appears to dip toward the Southeast. As far as disseminated, you really can't conclude anything about massive sulfides from it. The massive sulfides always accumulate due to some very local conditions. No conditions, no massive sulfides regardless of the presence of disseminated. Sumitomo underground drilling found some disseminated mineralization as well.

DeleteWhat it does indicate is it extended the massive sulphides in the Lower DZ by 12 m and the Upper DZ by 34 meters. Massive sulphides form as sulphide laden magma accumulates due to traps in dykes and conduits in the deposit (several have been shown in maps on the companies website). The rocks themselves are both mafic and ultramafic (which has been noted due to the magnesium content of the rock), which means it's an intrusive event - not local.

DeleteFair enough, I was talking about the deeper section of Hole 54. Ultramafic rocks are found in most nickel sulfide deposits in various proportions, if anything it points to volcanic arc origins at Nickel Mountain. Massive sulfides can accumulate a number of different ways including at margins and perched in an intrusion. The ones at margins like E&L probably have a more complicated history involving in situ processes (interaction with country rock). Another possibility is a very late stage for injection of the sulfides but you won't like that as that can't be considered a particularly "open" system.

DeleteHole 54 and hole one are by no means twinned holes. The azimuth on Hole 1 is 109. Hole 54 it's 55. That's a difference of 54 degrees. In what world is that "twinning"

DeleteI think Tom is referring to the facc that both holes were very close to one another, not exactly twinning, but we would call the scissor holes as they were essentially testing the same area twice

DeleteI still like "twinning" because it sounds like less of an accomplishment, which described Hole #54 quite well. At least with true scissor holes you can confirm orientation, but you would never drill those near vertical.

DeleteThese two holes are neither twinned nor are they scissor holes.

DeleteThey begin 6m apart at surface and end up 67m apart at depth. They are drilled in different directions and are nowhere near parallel to each other. Therefore, not twinned.

The holes originate at basically the same point and are drilled with azimuths of 109 and 55 respectively. This azimuth difference leads them to drift apart at depth, never once coming close to intersecting. Therefore, not scissor holes either.

EL-17-01 Central 396103E 6271502N 1892E 109AZ -80D 441L

DeleteEL-19-54 Central 396141.3E 6271466N 1886.5E 55AZ -86.5D 414L

Suggest you learn how to plot drill holes. 6 meters apart in elevation, 50 meters apart on the map grid. Though azimuths are different, the collar locations and dips cause the hole traces to pass within (less than) 20 meters of each other at depth. Now why would they want to drill this tight on a "second magma chamber"? One reason would be that other drill holes further away from hole 1 haven't intercepted anything interesting.

No offense But the Markets aren't "Churchy" guys.. you now better. Push and Pull Market factors are real. More Tonnage wouldn't hurt.!!!! (AFRICAN)

ReplyDeleteI was sent this link for an intelligent discussion but I cannot comment at all since its one of the dumbest things I have read in a very long time. The Data you are using is flawed, not sure where you are getting the data itself, maybe you are getting projects mixed up. All calculations are off by a wide margin. This whole post is in a different language. Everything is just bizarre. Your conclusion is wrong and I am left wondering what your point is considering its entirely Flawed. Please use real data relating to Nickel Mountain and produce an intelligent conclusion, I think you posted your kids playtime scribble by mistake.....Maybe its time to close the website...

ReplyDeleteThis comment has been removed by the author.

DeleteResidual grade on Hole 48 is 0.928 % NiEq over 39.75m, or 3.22 g/t AuEq - Definitely rock that would be mined since they are directly above the higher grade sulphides anyway. And the mill needs a lower grade mix to balance out the high grade. I do appreciate the point about hole 48 having a segment that contains massive sulphides. The disseminated sulphides above that segment would also be mined (who throws away 3.22 g/t AuEq that's sitting on top of the higher grade), that interval was near surface starting at 78m down.

ReplyDeleteMost of that is in the Leapfrog tonnage. The remainder doesn't amount to much. That said, I wish AG would just make this criticism for away by having a grade shell for all reported assays. They already apply a cutoff of 1% Ni/Cu for reporting and Garibaldi deserves credit for that.

Delete3.22 g/t is the remainder Tom - used the online drill hole interval calculator (core box), 44.5m is 6.88 g/t AuEq, my point is using ONLY the nickel value is a bit deceptive because the actual value is much higher. And if it were above 1500/tonne rock would be mined anyway

DeleteI don't think it helps to use AuEq unless you are trying to explain the tenor to a total newbie. The point of AG's Leapfrog exercise isn't to evaluate economics, it's to model tonnage. It doesn't matter if the grade shell only uses nickel, it's the same tonnage regardless. She doesn't include nickel under 0.5% though so there is an underestimation but it has nothing to do with excluding other metals. Now if you want to talk value, then we need to include the whole equation. Start with NSR (in which you can include all 11 metals), not raw metal prices, and deduct mining costs and the capital charge. Without that, it's a fantasy which is why 43-101 doesn't allow companies to do it either.

DeleteI just used the main metal Ni in the calculations as we have no idea of the recoveries for the PGEs, Au, Ag, Co as there doesn't seem to be straight line correlation between Ni and PGE/Au grades.

DeleteI think the point these people are trying to make is that the other metals besides Nickel make a substantial contribution to the rock value so even the lower grade sulfides (<0.5% Ni) could be economic. For reporting, Garibaldi is using a cutoff of >1% Ni+Cu and it would be helpful to see what a resource might look like incorporating all of that. It's not that unreasonable.

DeleteI'll check, it i a bit of a cheat using Ni+Cu as a cut-off as the value of Ni is >3x the value of Cu per lb.

DeleteWhat I'll do is update the data using a 3.2:1 price ratio between Cu and Ni and use NiEq% for the model.

I won't include the PGEs or Co, or Au/Ag as we don;t know their recoveries and if they will be paid for in the concentrates

I think this will help bracket the upper bound of a possible resource at lower global cutoffs.

DeleteAG admits she cheated on the resource, but props to TS for at least raising the question of doing a resource modeled on the value of the rock, not just on nickel. Duh, there are eleven metals in the deposit.

DeleteRegoci speaks directly to you both in this interview. Pay attention when he uses the word competent and geologist in the same sentence: https://www.facebook.com/FTMIGMining/videos/392942928047813/

So, Tom, you're admitting that AG's resource estimates were always on the low side because they didn't account for actual rock value? Mighty big of you to finally speak up honestly. It only took you years.

DeleteI should get round to doing this, remember that Ni has a value of >3 time Copper. I won't include the other metals because the PGEs don't seem to be 100% correlated with the massive sulfide mineralization and without any recovery data may be unlikely that they are payable in concentrates (the same with Co, Ag and Au)

DeleteYou're supposed to be doing a geological resource, not a feasibility on a reserve. Metallurgical recovery is not relevant yet. And what do you know about that, anyway? You should model the assay data you're given.

DeleteIf only poor old hoover-man had the tools to do this himself like a real geologist and not just playing one on his keyboard...

DeleteAnonymous troll, please stop mischaracterizing my position. I never stated that the Angrygeo Leapfrog is intended to show the maximum potential tonnage of the deposit but rather to provide a rough gauge of the high grade massive sulfide zone (which remains quite small). I have also suggested before to use a low global resource cutoff (>1%Ni+Cu) simply to answer critics. My own model of the deposit is purely volumetric, based on projection of the drilled envelope and assuming no voids or irregular topography (which are VERY VERY optimistic assumptions). Even with such unrealistic loose assumptions, the total resource tonnage is still below 5 million tonnes.

DeleteAn accountant and a "self appointed" geo walk into a bar...

ReplyDelete...and?

Deletethe accountant buys the geologist a drink because the geologist is poor...

DeleteI do not think this is funny. Is it meant to be so?

Deleteany insight into great bare resources (GBR). there is many talks about this company and next takeover in the miner sector for $2 billion or more by newmonts. can you help to answer, is he the real deal this company?

ReplyDeleteI need to look at the data, bit just a couple of comments/observations:

DeleteOne question to ask is - who would buy Great Bear? The best (and obvious) fit is Newmont and integrate the project with the Red Lake complex. However, they've stated that Red Lake is for sale, so it is unlikely that they will be interested is spending $400m on a project with a few interesting intercepts.

So, would a mid-tier gold miner (say Agnico) or Rob McEwan come in and buy both Red lake and Great Bear?

I haven't looked at the data in detail, but one concern is that a number of deposits ion the camp have shown "deviations in the geology and structures" (e.g. Cochenour, Phoenix and Bruce channel) that are probably still fresh in the memories in the people involved in those projects.

For me, I think GB will get taken out when they show good continuity in mineralization (maybe after an initial resource - if they can get it to 1Moz @ >10 g/t Au), or if gold gets to >US$1600/oz, when the FOMO will be strong and someone will come in and take them out.

My personal opinion, the share price is high as it is following the hot holes, and GB need to spend money on drilling to keep the share price frothy s potentially the price could drop if drill results don't meet market expectations

can help to find a dose of angry wisdom on great bare. it is hearing whisper of 3 billion value and newmonts sniffing in doorstep. you have any opinions angry geologist??

ReplyDeleteThe initial resource at Kiena was good, but a bit small, and the question is - what would Newmont be getting?

DeleteA small, profitable mine at Eagle River

A moderate (3Moz) open-pitable resource at Moss

A small high-grde resource at Kiena.

For companies like Newmont they are looking for projects with a minimum of 3Moz contained ounces and potential to produce >100,000 oz/year.

On those criteria, Wesdome is falling a bit short, but what about mid-tier miners?

Would an Agnico-sized company be interested, or potentially someone like Sandstorm?

Personally, I think the 3 deposits look good, and in my opinion, maybe Wesdome could do a Kirkland lake, and systematically bring their production up by bringing online Kiena to supplement Eagle River and get their annual production over 100,000 ounces/year.

I'd even argue Newmont and Barrick are probably looking at minimum 200,000 opa with potential to increase and grow mine life (10+ years). And also they would want projects where they already have the expertise (it could be argued this doesn't include small tonnage underground mining).

DeleteExactly, they would probably pick-up some smaller high-grade satellite deposits if it could add some value or extend the life of an operation, but as they want to sell Red Lake, they (unless it was stunning) wouldn't be in the market to spend more on the district

DeleteHey there Angry Geo! Do you have an email I can send you some info to? Happy Saturday!

ReplyDeleteit is theangrygeologist@gmail.com

DeleteI think it's entirely relevant to use metal recovery for a geological resource estimate. That's what a pit constrained resource does, although I acknowledge that this deposit likely would be an underground operation.

ReplyDeleteSpeaking of which, this deposit is quite shallow and outcrops on opposite sides of a steep protruding ridge at the top of a mountain. The main massive sulfide bodies (within 150 meters of surface) lie flat and between 5-10 meters thick. I'd be very interested, among other things, in the design of the crown pillar here if large tonnages are to be mined. Perhaps it would be possible to carefully remove the massive sulfides in the deeper areas via a selective operation. This argues for Angrygeo's model being restricted to the higher grades. If they wanted to do the total tonnage including disseminated, however, I don't think underground is realistic.

DeleteFew days ago ggi released drilling results. Any chance you make an update?

ReplyDeleteNi Massive X Mac Crack

ReplyDeleteI am very impressed with your post because this post is very beneficial for me