Calibre Mining (link)

reported some excellent drill results from their Cerro Aeropuerto prospect that

they returned wide high grade gold mineralisation and to quote them directly:

Highlights

- The 2015/2016 Diamond Drilling Program on the Cerro Aeropuerto Prospect being funded by Centerra included 1421 metres completed in 5 drill holes.

- Results for the remaining holes include CA15-022 which returned a weighted average of 53.7 metres grading 10.47 g/t Au including 2.7 metres grading 120.58 g/t Au (uncut)

But if we look at the accompanying

drill-hole intercept table we see:

| Table from March 22nd press release. |

Not

from Cerro Aeropuerto

|

So they reported that they drilled a think zone with some good gold numbers, but I don;t think that we are being shown the whole story, and there are a few clues if we dig a bit deeper:

- The biggest mine in the area is called the Bonanza Mine.

- The table contains some narrow, very high grade intercepts (see point 1)

- There is a little note below the table carefully put in 6 or 8 point text (for environmental reasons as using a small font saves on paper) stating that the "length weighted averages (are) from UNCUT assays".

So we put that together and the

evidence suggests that most of the gold is actually in narrow, high grade

veins. Often companies use uncut assays as a way to increase the average grade of the mineralisation, to make it look as big/wide as possible, is that happening here?

So I took the gold intercepts from

the March 22nd press release and associated maps and figures, typed in as much

of the drill-hole data as possible, I created 2 tables:

- The original table just listing the intervals that are in bold

- A table where I split apart the assay data into high grade narrow intercepts and the back calculated residual grades.

This what the intercepts look like from Calibre

press release table. A series of wide gold intercepts that appear to suggest that the gold zone is very continuous and gold grades increase with depth.

Potentially this zone could be amenable to bulk mining, but if we start to separate out the narrow high

grade zones from the rest of the intercepts, this is what you see:

Those wide zones of >1g/t and >2.5 g/t Au suddenly disappear. They are replaced by narrower, high grade intervals that are surrounded by wide zones of low grade (<0.5 g/t) mineralisation.

Please note: there are still a few holes that still show thick zones of good mineralisation. These were drilled by Yamana Gold in 2007/8 and I have only been able to find summary assay tables from them. I feel that they will also show a similar pattern to the recent, with narrow bonanza-grade veins with a low grade halo.

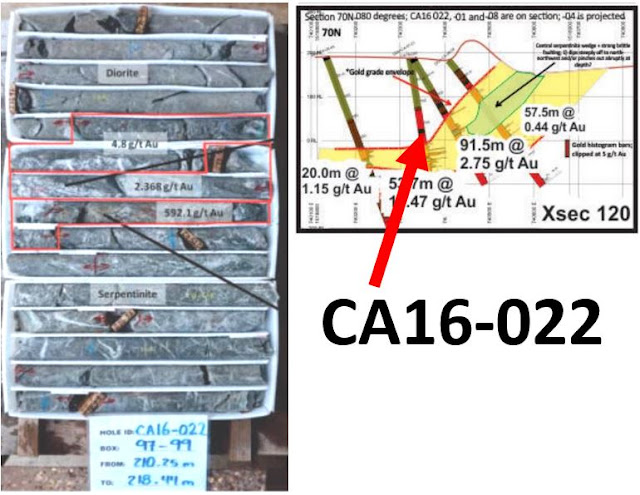

Why don't we take a closer at drill-hole 022,

with headline leading 10.47g/t Au over 53.7m, do we see any changes?

The headline grabbing 53.7m at 10 g/t Au disappears when we strip out the

effect from the narrow high grade zones, we see that in reality we don't have a

single thick gold zone, but 2 narrow bonanza grade veins surrounded by a lower

grade mineralisation.

This means that these 2 narrow zone,

with a combined core length of just 1.64m (i.e. equal to the height of Scarlett

Johansson or Natalie Portman) out of a reported length of 53.7m contain 84% of the gold.

I haven't visited the

property and the only drill-core I have seen is in photos accompanying the

press releases. Here is the high grade interval from hole 022 and the corresponding section through the deposit.

We can see that the hole has been drilled at a -80 angle of dip (close to vertical), and if we rotate the photo of the core so it is also orientated at 80 degrees, this is what we get.

We can see that the hole has been drilled at a -80 angle of dip (close to vertical), and if we rotate the photo of the core so it is also orientated at 80 degrees, this is what we get.

I've drawn on a few lines in yellow that look like contacts and trends within the vein and they suggest that the vein could be vertical, yet when we look at the cross section above, the gold zone is drawn as being more horizontal in attitude.

My gut feel is that the drilling has

intersected a series of narrow, high grade, close to vertical veins surrounded

by a wide-ish zone of low grade mineralisation. Something more like this:

The big question will be, are there enough of the high grade veins to allow Calibre and Centerra define a bulk tonnage deposit, or is there good potential to define a smaller, high grade zone?

Here is a link to the leapfrog viewer file (link) so you can look at the data for yourself in 3D

The big question will be, are there enough of the high grade veins to allow Calibre and Centerra define a bulk tonnage deposit, or is there good potential to define a smaller, high grade zone?

Here is a link to the leapfrog viewer file (link) so you can look at the data for yourself in 3D

Great analysis TAG, and thanks for doing a post on Calibre so quickly! As an investor in the stock, I will certainly keep an eye out for the tricks you mentioned.Do you think its possible to boost the resource on this prospect to 1 million oz's? The current resource is around 700k inferred I think.

ReplyDeleteAlso, if you ever have the time/inclination it would be great to hear what you think of their other 2 joint ventures.

Cheers and thanks again!

Looking forward to more posts TAG! They should put out some drill results soon from their Iamgold JV, would be interesting to see if they use the same tricks on that one.

ReplyDeleteCheera and thanks!

Ah,I see. Looking forward to the post! They do promote the property that hosts Blag vein system as having multiple km's of strike with multiple vein systems, I think they still need a lot of work to prove the vein systems are economic. Maybe thats why the stock price hasnt really moved much.

ReplyDeletei love all the reviews you post but this one is so far my fav. very informative and taught me a lot of new things i didn't know. i should take notes! thanks for being kind enough.

ReplyDelete