So we have the Taylor PEA, it is lovely, beautiful and highly profitable. I've actually started sleeping with it, so I can absorb its awesomeness while I'll sleep, but sometimes every silver lining has a black cloud.

Summary:

- Bye bye Central, it was nice to know you

- They managed to get virtually all of the infrastructure onto the private land, but there appear to be a few Achilles's heel

- water pipes need to cross the public land

- they'll need to upgrade access roads and probably power-lines that cross the National Forest Land. It could be hard to get easements

- The recoveries used in the PEA look unrealistically high, especially as the ore close to surface has lower recoveries.

- the good ore is deep, so the first few years production could generate 10-15% less revenues, what knock-on will this have to the NPV, IRR and payback period?

Do you like the way that AZ have squeezed everything onto the private land. That was some impressive origami, they managed to get everything on squeezed into the private land.

|

| I've added the outline of the central pit |

However, they didn't quite get everything onto the private land, just a few irritating water pipes from the various water wells that they need to supply water to the mining operations. They couldn't drill in the public land so a couple of tubes will be fine.

|

| red circles = where there is infrastructure on public land |

But, I'm confused, I was looking at the numbers in table 22.2 (page 215), as I was playing with the numbers, and I was checking the recoveries against the results of the metallurgical test-work.

You can see that the projected recoveries vary by zone, which is perfectly normal, we have a different amounts and types of lead, zinc and silver minerals. The very poor zinc recovery in the Scherrer zone is because the zinc is in silicates, not sulfides, and cannot be recovered through flotation.

However, as you know, I like to check the following:

- How do the grades of the metallurgical samples compare to the overall resource

- here we have a nice range, from 2.5% - this is going to be close to the cut-off grade, i.e. the lowest grade material that can be mined economically.

- We can also see that recoveries increase with grade

- This is also very typical

- Are the recoveries used in the financial model in-line with the results received from the various metallurgical tests. Recovery values used in the PEA

- Zn = 92.7%

- Pb = 95.4%

- Ag = 92.4%

Here are some nice pictures to show how they compare against the projected metallurgical recoveries (tables 13.5, 13.6 and 13.7) reported in the PEA.

I've added some nice, thick red-lines to show the recoveries used for each metal used in the recent PEA. You can see that only the Epitaph ore have recoveries that match the numbers used in the PEA, for the other zones they are, in some cases a lot lower. This is where the different zones are located:

|

| Taylor ore-zones |

|

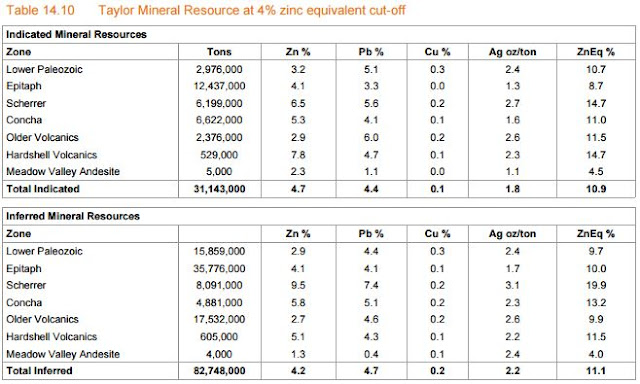

| Table 14.10 from the |

Where is this this material going to come from, and why is it important?

- Manto zone - contains oxides, won't be mined

- Scherrer zone- low Zn recovery, unlikely to be mined

Hi AG, thx for that post.

ReplyDeleteCould you explain why do they have to mine the concha zone first? isn't it possible to focus on deeper zones first?

Hello Unknown,

ReplyDeletethe simple reason is time and costs. to get into the Epitaph zone they will have to build a deeper shaft and a longer decline.

shaft sinking costs - I'm not an expert, but a google search shows costs ranging from US$4000-10000/meter

decline costs = US$2000-3000/m

So if you add an additional 300m of shaft construction and 2500m of decline that will add a few million to the capex, but more importantly will take probably around a year to excavate them. As a mine needs to maximize the present value of the ore extracts, it needs to mine the highest grade material first, and so I would expect that they would aim for the best part of the Concha resources while they are developing into the Epitaph zone.

if there are any mining engineers reading this, feel free to chip in and correct my costs (please)

Decline costs could be as high as $2-2.5K/m if there ground is bad, but I feel $1500 would be a better.

ReplyDeleteTotally right about the timing and early access to ore.

Nice analysis TAG :)

Hello Blue Bull - ok, I'll update the costs to US$1500/meter, but what advance would you expect for a 4m x 4m ramp? 1-2m a day?

DeleteWhat would you estimate development rates for shaft sinking?

Does the private placement from South32 change the equation for you in any way? Seemingly South32 has a pretty good handle on the manganese issues (or non-issues) and the relatively small permitting/regulatory burdens presented in the PEA is promising. I know you have been pretty critical of this project, but seems you are coming around ever so slightly? Or do you think this project is still dead before it gets out of the ground?

ReplyDelete