I apologize, I was farting around with Blogger and deleted the original post - so from now on I'm the SAG (Stupid Angry Geologist), please excuse me, I'm off to find someone to blame.....

Here is the original post:

Wellgreen - this is going to be easy, we already know that it is

going to be crap, because...

|

| Nice ATV.... |

Summary

- Wellgreen is a PoS

- Big, low grade, high capex 'deposit'

- very positive metal prices used in the PEA

- Ignore it and Northmet as well.

I also like the way that they go out swinging and compare Wellgreen with a load of other Ni-PGE projects and mines, and show that it is

|

| Nickel |

|

| PtEq |

Feck, don't you hate it when you leave your Ni-PGE project in your

pants pocket, it goes through the wash, and you find that all the metal has

been washed away? BTW - smaller bars are not better, but the presentation does

give us some useful advice - "avoid Northmet".

I like to compare exploration projects against active mines, basically to see

if they are good enough to go into production. We can check Wellgreen against

the results from the Kevitsa Mine (Boliden - Finland):

|

| look at how much money they don't make.... |

So Wellgreen's

message is - "Buy our shares, our project is worse than a break-even

mine".

I also got a good chuckle on how they calculated the equivalent grades

I also got a good chuckle on how they calculated the equivalent grades

- NiEq - from Ni, Pt, Pd, Cu, Au, Ag, Rh, Co

- Maybe they should have included Mn for fun? Everyone one

loves Mn....

- They used some high metal prices in the PEA, so at

today's prices (bold), it is definitely uneconomic.

- Au = $1250/oz ($1204.1/oz)

- Cu = $3/lb ($2.62/lb)

- Ni = $8/lb ($4.55/lb)

- Pt = $1450/oz ($940.9/oz)

- Pd = $800/oz ($754)

Heck, the metal

prices used in the PEA were nowhere close to the current metal prices, a

typical, fudge the numbers to make sure the deposit seems economic and hope

that the readers are too stupid to understand.

It is so lucky that

the project is located half-way to the north pole and require a large CAPEX....

Let us look a bit closer at the resource, maybe there are a couple of higher

grade areas that could be expanded?

|

| NiEq Grade distribution |

|

| PtEq Grade distribution |

So, there are a couple of teeny weeny higher-grade zones. Nothing out of

this world, and the resources can be expanded to the east (left in the image

above).

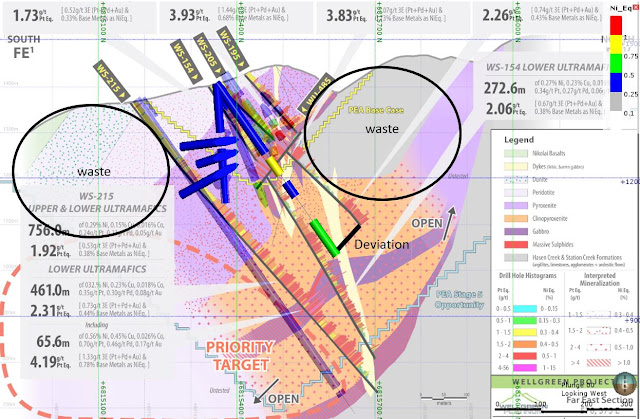

At depth they like to show a lot of upside, telling us that lots of holes ended in "high-grade"

At depth they like to show a lot of upside, telling us that lots of holes ended in "high-grade"

|

| look at the cyan line - the PEA stage 5 opportunity pit outline |

It isn't that special, yes, they can expand some of the deeper

mineralization, but that it going to significantly increase the amount of waste

rock (outlined in black) they have to move, and that cost will kill a marginal

grade deposit.

Wellgreen do have a decent amount of cash, but the Wellgreen deposit has been well explored. There is upside to outline more resources, but what they really need to do is try and find a high-grade zone, because having "more of the same" (i.e. lots of low grade crap) isn't going to help.

You need to look beyond the big resource numbers and look at the grade and ask yourself - Where is the upside? If you are wanting to bet on Nickel, go for it, but the mineralization at Wellgreen is going to sit in those hills until the next glaciation.

you can get the 3D model from here (link)

Otto Rock put it more succinctly:

Conclusion: With the phrase “One Of The Largest Undeveloped (insert metal of choice) In The World” we have a hack, a short-cut to know when a bunch of mining parasites are trying to rip us off. So if you see it in company literature, in a promo pump or perhaps quoted by a CEO in an interview, you now know what to do!

Wellgreen do have a decent amount of cash, but the Wellgreen deposit has been well explored. There is upside to outline more resources, but what they really need to do is try and find a high-grade zone, because having "more of the same" (i.e. lots of low grade crap) isn't going to help.

You need to look beyond the big resource numbers and look at the grade and ask yourself - Where is the upside? If you are wanting to bet on Nickel, go for it, but the mineralization at Wellgreen is going to sit in those hills until the next glaciation.

you can get the 3D model from here (link)

Otto Rock put it more succinctly:

Conclusion: With the phrase “One Of The Largest Undeveloped (insert metal of choice) In The World” we have a hack, a short-cut to know when a bunch of mining parasites are trying to rip us off. So if you see it in company literature, in a promo pump or perhaps quoted by a CEO in an interview, you now know what to do!