DISCLOSURE: I own shares in SolGold

I promised to review the technical report on Cascabel, so here it is. I apologize that it took some time, I've been withoutt internet for a weeks

Simply put, this report is a qualifying report for SolGold's listing on the TSX and a setting the foundation for the initial resource estimation that we are promised to receive in December (link).

SRK are checking that the project exists, the drilling and sampling have been done to best practices, and that there are no major technical issues. It also outlines historic exploration and proposes some future work programs.

Summary

- Nothing groundbreaking, but a lot of useful info

- Good geology

- big regional structures = good plumbing

- big Batholiths = good potential Cu source rocks

- Some good neighbors (a good indication of potential in the area)

- Data collected is high quality with no issues

- early Met test in 2014 show good recoveries

- SRK mention minimal deleterious elements

- Exploration potential

- Alpala and Aguinaga are the best prospects, and received the most attention

- NW prospects appear to represent the tops of deeply buried systems

There is a lot of text, so you don't have to read on!

Section 1 - The introduction tells us what SRK did and didn't do, what data sources they used and the scope of work. It was interesting that the report was completed in February 2017.

Section 3 - this tells us where the project is located, but also some background on the mining and environmental laws in Ecuador, as well as the holding costs, any underlying agreements, and the tax regime (page 19) if the project gets developed.

- Income Tax = 22%

- Labor Profit Sharing tax = 15% (12% to the state and 3% to employees) for a large scale mine

- VAT= 14%

- Municipal taxes, social security

- Royalties = 8% on Copper, Silver and Gold

- Windfall tax = 70% of the gross obtained from the sale of mineral at a higher price than the base price established in the Mining Exploitation contract

The windfall tax is interesting and I'll need to research a bit more to see what it fully means, does it mean that if the base price for Au and Cu is set at $1300/oz and $3/lb, the mine will have to pay 70% of the gross revenue received over that amount, so this means that once a project moves towards production, there has to be careful negotiation to set this price as high as possible so you have a lot of wiggle room?

Section 4: this tells you if access to the project good or bad (big impact on exploration costs if everything has to be helicopter supported) and how far away are power (for the mine) and transport links (to ship out the concentrate to the port).

This is useful to check so that if the project gets developed that the operator won't need to spend a large amount of money on a power plant, port, concentrate pipeline etc. that can add a lot of bucks to a project's CAPEX, basically look for some black clouds on the horizon.

At the moment, everything seems OK, there is a rail link just north of the property that runs to a port (they may need to check capacity as when (if?) Codelco's mine gets going, it may use it all up).

There is also a small section on climate and physiography. this will have an impact on construction costs (can they use the morphology to fit in the dumps and surface facilities or do they have to flatten hit tops etc.)

Section 6: This is the key section is we want to determine the potential at Cascabel.

We want to see:

- Plumbing: A big regional structure running through/close to the project (the Cauchi-Pujili Fault Zone)

- Potential: Are there any other big deposits in the area

- Mineralization Source: Some big batholiths (the red and pink blobs in the map below)

We can see that Cascabel has all three, but we need to remember that not all porphyries, in this area will be mineralized!

Local Geology - it is always good to have a quick look at the rocks exposed in a project, as they can have a significant impact on mineralization:

- Limestones - potential to form high grade skarns (think Antamina, Las Bambas etc.)

- Andesites - contain Iron that can be used to precipitate copper (chalcopytite is an FeCu sulfide) minerals.

I also like Figure 6-6, it is a good overview on how you can use soil geochemistry to define exploration targets. Copper porphyries, like any deposits have a well defined geochemical signature (this varies by exposure level and host rock that can shrink or expand these anomalies).

You may ask why there is no copper map. This is because it is easily leached from soil and we are in a tropical environment.

The Mo is much more stable and will generally remain insitu.

The Manganese and zinc are exhaust metals, they require lower temperature and pressures to be precipitated and are found much further from the porphyry. We can see that where are some nice strong Mn depletion zones at Alpala and Aguinaga, which is again a good indication of where the poprhyries are located.

The Cu/Zn ratio is very useful as it highlighting any weak copper anomalies in the core of the system.

You can also use the geochemical signature to check the exposure level, it looks like Americas, Chinamibcito have smaller, more subtle signatures, and this may represent more deeply buried porphyry systems (drilling will have to tell us how deep they are).

Mineralization

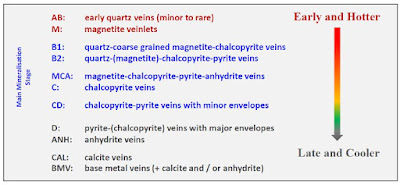

There is a lot of geobabble here, however, figure 6-9 is the most interesting

A load a wank I know, but it tells us that the copper is introduced by B-veins, which is what they have found at surface at Aguinaga just a 1000m closer to surface.

Alteration - just some geowank, it is interesting to geologists and can be useful to vector towards the core of a system, what is important is the size of the alteration system, simply put:

- big alteration = big system

This doesn't mean that the porphyry will be mineralized, but increases the potential.

We'll ignore the bar plots, the scatter plots show that Cu and Au generally occur together (no surprise there).

Structural geology

this is interesting, this shows the potential targets, but a big about porphyries. Simply put, porphyries are formed when batholiths cool and incompatible elements (i.e. Cu and Au) are 'released' by their host minerals. These incompatible elements go into a mush/liquid that rises and pools in highs (technical term is apophyse) in the batholith roof.

These highs are often formed in zones of weaknesses, i.e. where multiple structures intersect and break up the rocks, for example:

So we see that we have multiple zones of weakness where the three structures intersect that see to correspond to Alpala deposit and the other exploration targets.

So we have good plumbing, with Alpala we know we have a source that was rich in Cu and Au.

I just want to include a brief message about geophysics, you often see a large chargeability anomaly surrounding a porphyry as it is detecting the pyrite halo which is generally unmineralized.

It irritates me that so many junior exploration companies insist on drilling the red blob and don't drill the changeability low in the middle. The reason for this is that the halo can contain >5% Pyrite whereas the core may contain 2-3% Chalcopyrite and therefore appear to be a (relative) low.

We also get a nice section (6.3.4) talking about the otehr prospects, and we basically see that there isn't much as most exploration activities have focused on Alpala and Aguinaga. These can all be put in the 'needs more work' category. they all have similar 'features' to Alpala, but their potential is unknown until a truth machine (drill-rig) arrives and puts a few holes into them.

SolGold have focused on the 'best' targets and haven't been very distracted by the regional prospects.

Section 8 - exploration.

This gives us a run down on what SolGold have done on the project. this is fairly standard, but if you have invested in another porphyry exploration company, check to see if they are doing the same.

I like the fact that they have done proper channel samples with a saw so that they are unbiased. This is good, it means that these samples could be used in a resource estimate as they are essentially horizontal drill-holes.

Section 9 - drilling

For me, I'm going to steal the hole coordinates to rebuild my model, but what you want to check is that:

- Have they surveyed the collars properly (DGPS or professional surveyor) as handheld GPS can give errors of up to 20m, or worse in steep or forested terrain

- Have they done a proper down-hole survey (gyro is best, followed by EZ-shot and if they are using a tripari or acid bottle, or not surveying - run away)

- is the recovery good - 97% is excellent, there is probably slight loss at the start of the hole (you wash away some soil) and in fault zones. If you see less than 80%, be concerned.

- Orientated core - is a nice bonus it helps measure vein, contact and the orientation of structures.

- Are they storing the core (think Bre-X), and where are they storing it

- at site means they have to build warehouses

- off-site - they are renting warehouses

Section 10: Sample prep

This is where we can see how the data is being collected and if Solgold are meeting (or exceeding) standard practises.

I like the fact that they are collecting Specific Gravity measurements as they drill (1 per core tray), as when the project evolves this will be very useful to accurately calculate the destiny of the rock and mean that the tonnage calculated will be precise.

Sample selection - this tells us that they are sampling everything (mineralization at ~2m widths, waste at 6m widths). This costs money, but will allow them to create a detailed alteration and mineralization model that could help to vector their drilling on other targets. Most companies don't do this (as it is expensive).

Section 11. QAQC

This is to show that the data they are receiving from their assays is any good. We can see that early in the project, when they were using Acme labs, the data was poor, so they changed to ALS and then Met-solve that have produce much higher quality samples.

We also see some minor issues with the blank standard, this seems to be picking up some calibration errors in the analytical equipment (it is typical that there is 'drift' that means the machine needs to be calibrated frequently).

One question I did have was regarding the low quality results from Acme (almost 60% of the analyses) but SolGold have sent a load of samples to Metsolver to verify the Acme data and it appears that the results are comparible.

Section 12 - Met study

Wow, an early metallurgical test, this is a very pleasant surprise. Solgold are checking to see if there could be any issues with recovery, way back before they started to spend big bucks on drilling. This is an early test just to check that the gold and copper can be recovered by standard methods and they good some good results:

- 86.5% recovery for Cu

- and ~80% for Au

Not brilliant (Cu recoveries in a typical porphyry should be >90%), but it is a start.

Section 22 - Adjacent properties

This shows who their neighbors are, and potential players in the area. Why isn't the area to the north staked? Is there a national park there?

It is also important to see how close the deposits are to the property boundary. Fortunately, here both are well within, so there is no need to deal with greedy neighbors.